Photo credit: @Kwame Amo/Shutterstock

A farmer in Kenya uses mobile apps to get real-time harvesting tips, check market prices, and connect directly with buyers and lenders. A woman in Indonesia takes meal orders and arranges deliveries through social media. A small innkeeper in Jamaica lists rooms on booking platforms and manages reservations online. A street vendor in Dakar sells handmade jewelry across Africa using just her smartphone. And in Manila, a university student teaches math to high schoolers in remote areas via an online e-learning platform.

These types of stories are becoming the new norm as the traditional model of salaried employment rapidly evolves. Millions of people are redefining what it means to work as they earn income through self-employment and gig work. Digital platforms like Junia, Shopee, Uber, and Upwork are at the heart of this transformation, allowing people to reach customers, manage their businesses, and receive payments—all from the palm of their hand.

Most workers can have payments sent directly to their financial accounts, opening doors to other financial products like savings and insurance and enabling the innovative delivery of social transfers.

New data from the Global Findex 2025 report reveals many of these trends on technology and financial inclusion and tracks how prepared countries are to seize the opportunities of a digital job economy.

Connectivity: The foundation for opportunity

Access to this new world of work starts with connectivity. Our Findex report shows that 84 percent of adults in low- and middle-income countries (LMICS) own a mobile phone, and three-quarters of those are smartphones. With 90 percent of internet users in these countries accessing it via mobile, smartphones have become the primary gateway to income-generating digital services.

The data also show that 6 percent of adults in LMICs already earn money online, a figure that rises to over 10 percent in East Asia and the Pacific (excluding China). Social media is playing a growing role in this shift. Nearly half of adults in LMICs, representing 80 percent of internet users, now use social platforms not just to connect personally, but increasingly for informal e-commerce and digital marketing.

Digital finance: Unlocking growth and resilience

However, connectivity alone isn’t enough—self-employed workers also need access to digital financial services to thrive. Payment-enabled channels allow entrepreneurs to market, transact, and manage their businesses all from their phone.

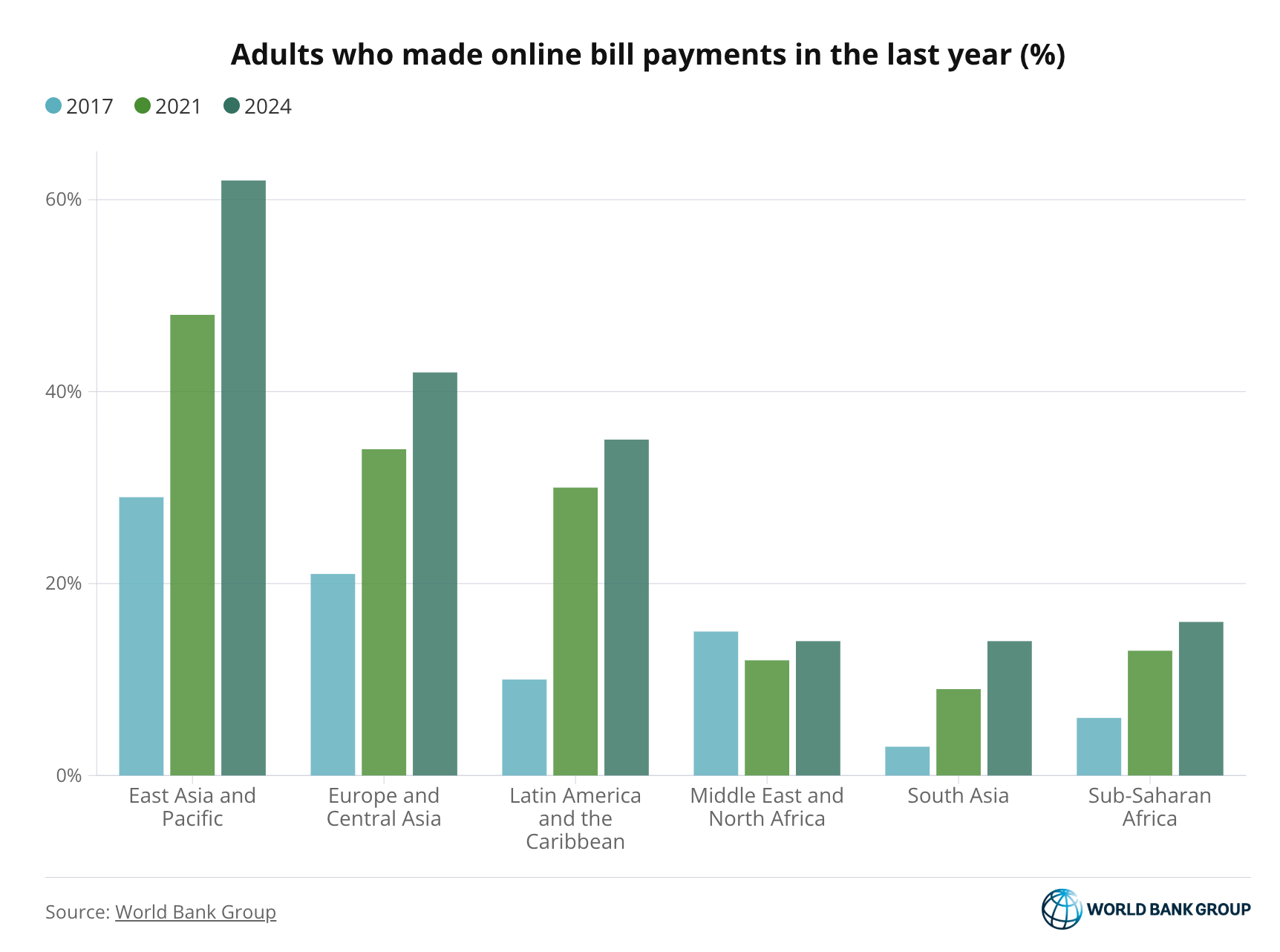

Consumer engagement with digital finance is expanding rapidly, as 80 percent of account owners in LMICs have either made or received digital payments in the past year. That’s not all. Our new data finds:

- About 40 percent of adults in low- and middle-income economies pay bills online.

- Over a third buy their goods online.

- Since 2021, digital merchant payments—in-store or online—have grown significantly and are now used by over 40 percent of adults.

Accepting digital payments through mobile money, QR codes or banking apps not only protects income from theft but also creates a digital transaction history. This data trail helps businesses track cash flows and enables other financial tools, such as credit from lenders who can use this “alternative data” to assess creditworthiness. This approach could help reduce reliance on informal lending, which currently supports 17 percent of self-employed adults who borrow for their businesses.

This digital ecosystem also fosters financial resilience. Receiving income in a digital account makes it easier to save, providing capital for future investments and a buffer against economic shocks like lost contracts or assets damaged in a storm. Since 2021, the share of adults in LMICs saving in a formal account has increased from 24 percent to 40 percent, largely driven by mobile banking, allowing users to more affordably and frequently set aside small amounts of money.

These savings can then be reinvested in businesses or used to acquire new skills. In fact, 26 percent of adults in LMICs—almost half of all internet users—go online to learn, which can help them improve their services or enter new markets.

Bridging the gaps: Challenges remain

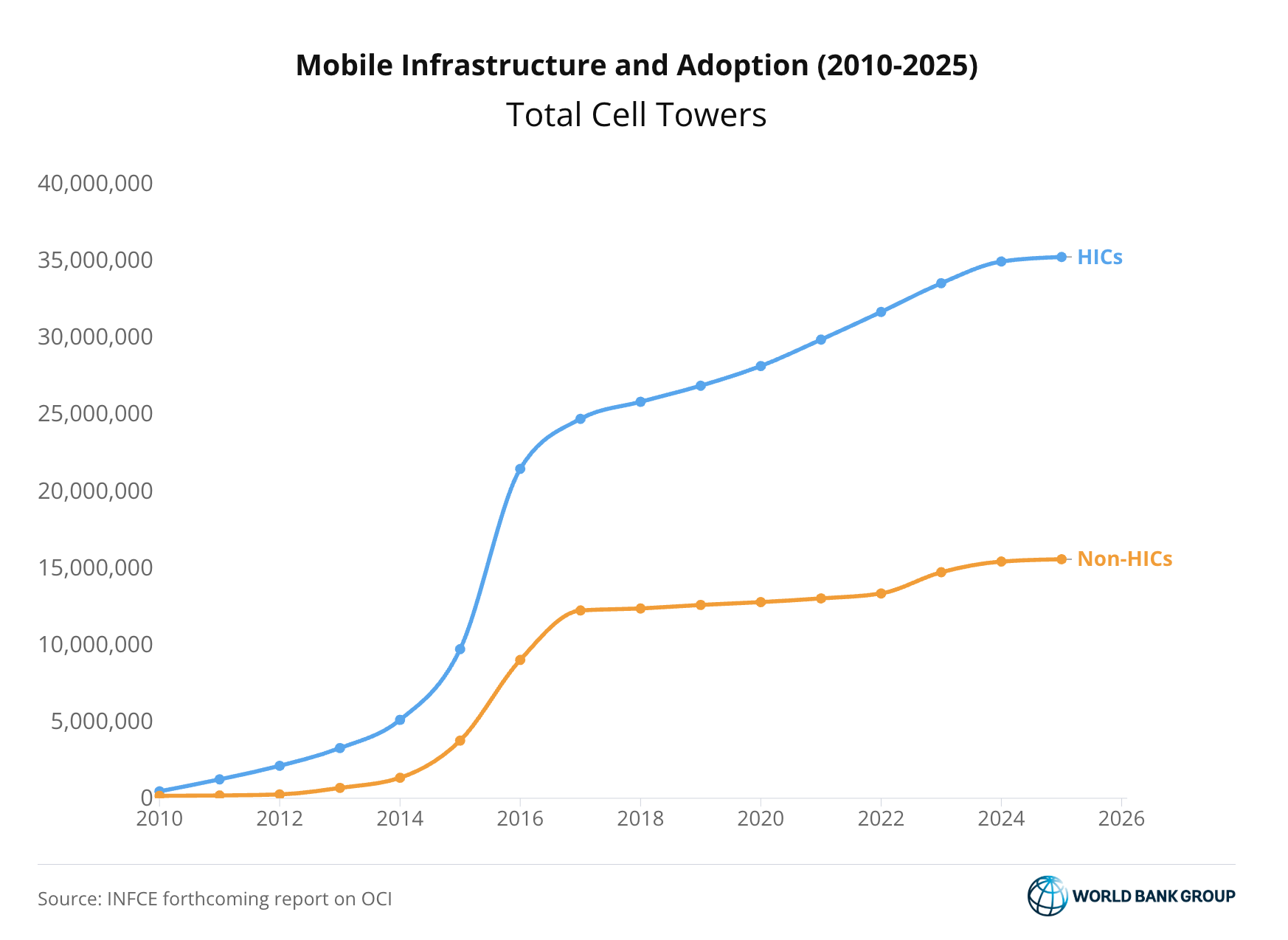

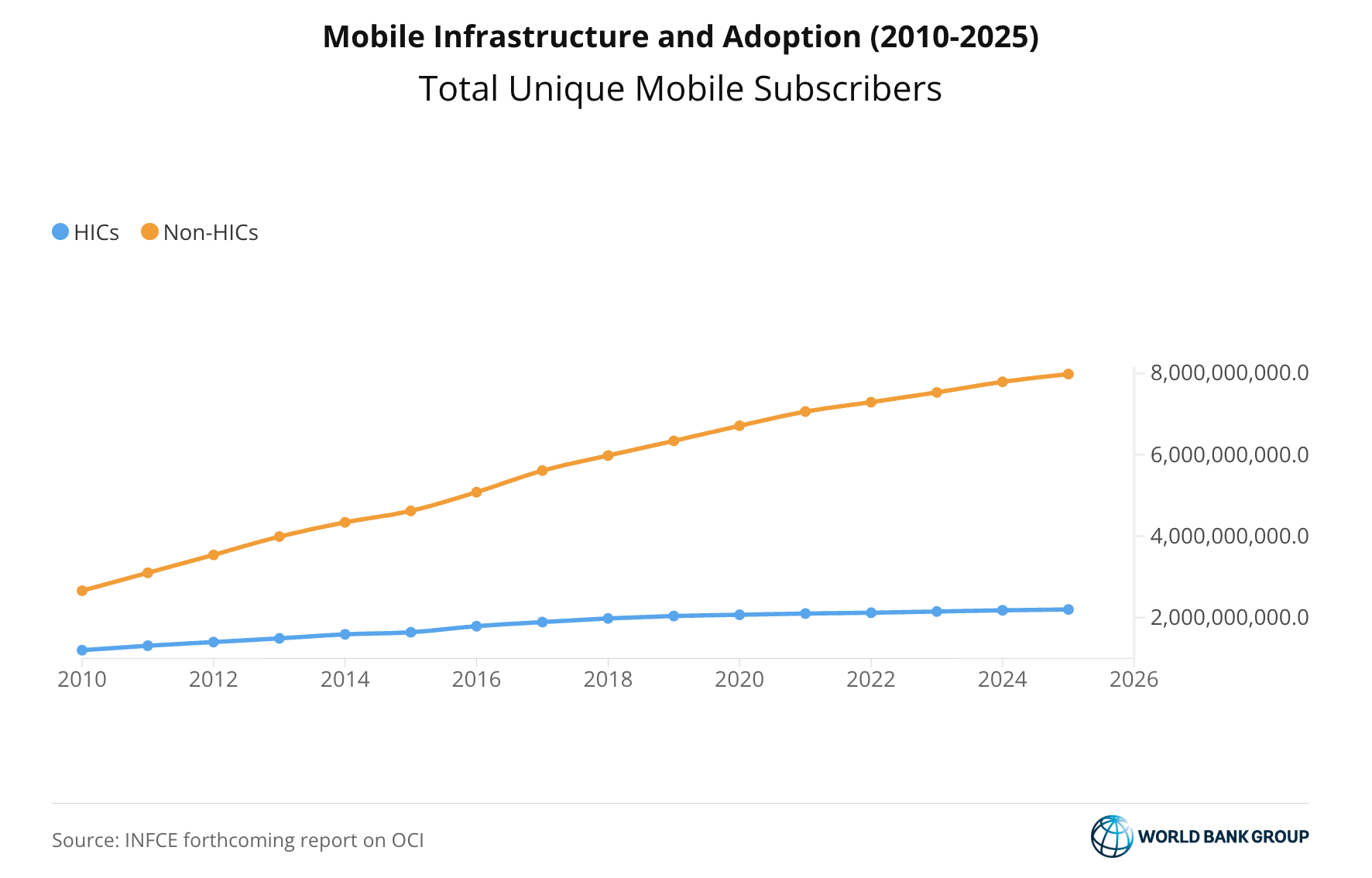

Despite this immense potential, significant challenges remain. There are still big connectivity gaps, especially in South Asia and Sub-Saharan Africa. Capital stocks information collected by our Infrastructure Chief Economist’s office attests to a deeply unequal distribution of digital infrastructure across the world. LMICs are home to 77 percent of the world’s mobile subscribers but have only 30 percent of its cell towers—a gap that continues to widen (see Figure 1). The situation is even worse when considering quality, as, for example, less than 5 percent of towers in low-income countries (LICs) are 4G and 5G, compared to 40 percent in high-income countries.

This is compounded by a lack of international connectivity. Nearly half of all LICs with submarine cables rely on just one or two landing points, leaving them vulnerable to service interruptions. The global distribution of data centers underscores this challenge: LICs and LMICs host only 0.2 percent and 6 percent of all global data centers capacity, respectively, according to the forthcoming Digital Progress and Trends Report 2025.

As a result, millions of people still lack consistent access to smartphones and the internet. These disparities are particularly acute among youth, rural residents, and people in the lowest 40 percent of income brackets. For instance, women in LMICs are 9 percentage points less likely than men to have a smartphone. Affordability is the single biggest reported barrier. In Sub-Saharan Africa, an entry-level smartphone can still cost 73 percent of a poor household’s average monthly income.

Beyond access, there is a critical need for digital literacy and robust security. For example, 40 percent of adults with a phone don’t use password protection in LMICS, including half of mobile money account owners in Sub-Saharan Africa. Strong consumer protection laws and inclusive regulatory environments are critical to ensure that all self-employed adults can participate safely in the digital economy.