This is the sixth blog in a series about Business Ready (B-READY), a World Bank flagship report that assesses the global business environment. The first blog, Data for reforms: Leveraging the B-READY 2024 report for enhanced business environments, offered guidance on how to effectively navigate and leverage B-READY data to enhance business environments; the second blog, Data-driven transparency: The need for easy access to laws and regulations for businesses, explains the importance of transparency for businesses to thrive; the third blog, Minimum wage policies through the lens of data-driven insights, dives into the role of minimum wage in labor markets; the fourth blog, The right place at the right time: Why business location matters for firm success, deals with the link between physical location and how that can boost its performance; the fifth blog, Can economies strengthen financial integrity without restricting SME access to finance? Data insights from B-READY 2024, dives into the restrictions smal and medium businesses face when applying for finance sources.

Digitalization has transformed the interaction between taxpayers and governments, shifting from paper-based transactions to more streamlined electronic processes.1,2 This shift to tax e-payments enables faster processing, reduces errors and administrative costs. According to the World Bank’s Revenue Administration Handbook, taxpayers worldwide have widely adopted e-filing and e-payment systems, with medium-sized firms rapidly following suit. While the advantages of going digital are well-recognized, specific features can significantly shape user experience, data security, and overall costs.

Using data from Business Ready (B-READY) project’s Taxation topic3, this blog explores the prevalence of electronic tax payments, the role of governments in enabling access to tax e-payments, and the drawbacks of relying exclusively on third-party online payment providers.

The rise of electronic tax payments

E-payment of taxes reduced the cost of compliance for taxpayers, as it minimized or eliminated the need to travel, wait in queues, and interact with tax officials who might solicit bribes.4 For tax administrations, e-payment provided more reliable and timely information, as well as improved the monitoring of taxpayer compliance.5 Kochanova, Hasnain, and Larson found that complementing e-filing with e-payment significantly reduces tax compliance time.6

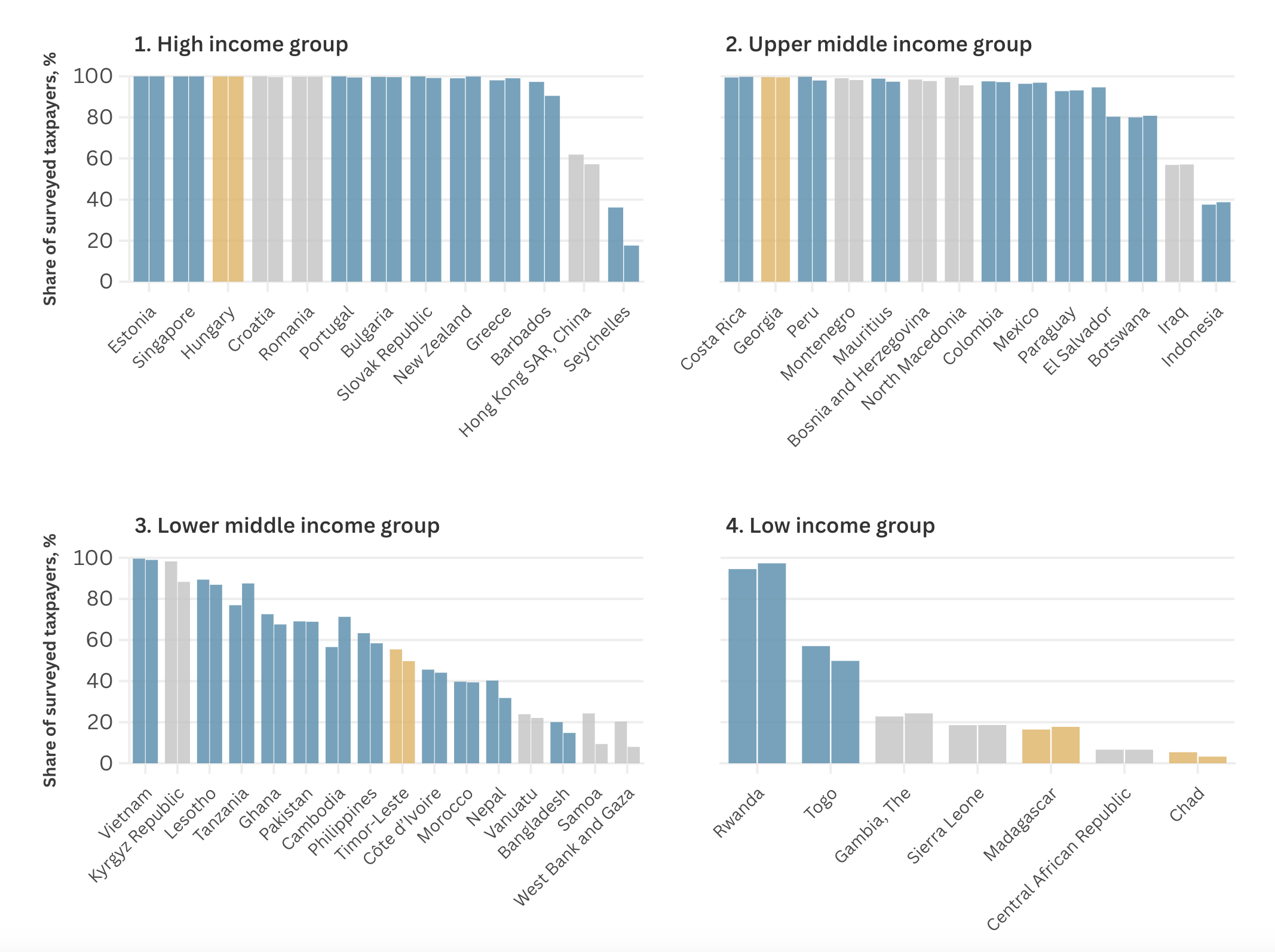

Despite the clear benefits, the adoption of electronic tax payments remains uneven. Figure 1 illustrates that economies in high- and upper-middle-income groups tend to have a higher share of firms that file and pay taxes electronically, compared to lower-middle- and low-income economies. While this disparity may stem from differences in infrastructure, regulations, and technological resources, taxpayers and tax authorities in low- and lower-middle-income economies stand to benefit the most from digitalization, given their limited infrastructure, fewer resources for tax collection, and higher administrative costs.

Figure 1: Percent of firms that file and pay taxes electronically, by income group

Direct e-payment via online tax portals

Many revenue authorities offer integrated taxpayer portals—secure, one-stop gateways through which users can view their account details, file taxes, and pay taxes. The World Bank’s Revenue Administration Handbook refers to these as “virtual tax offices”, centralizing all key functions to reduce compliance burden.7

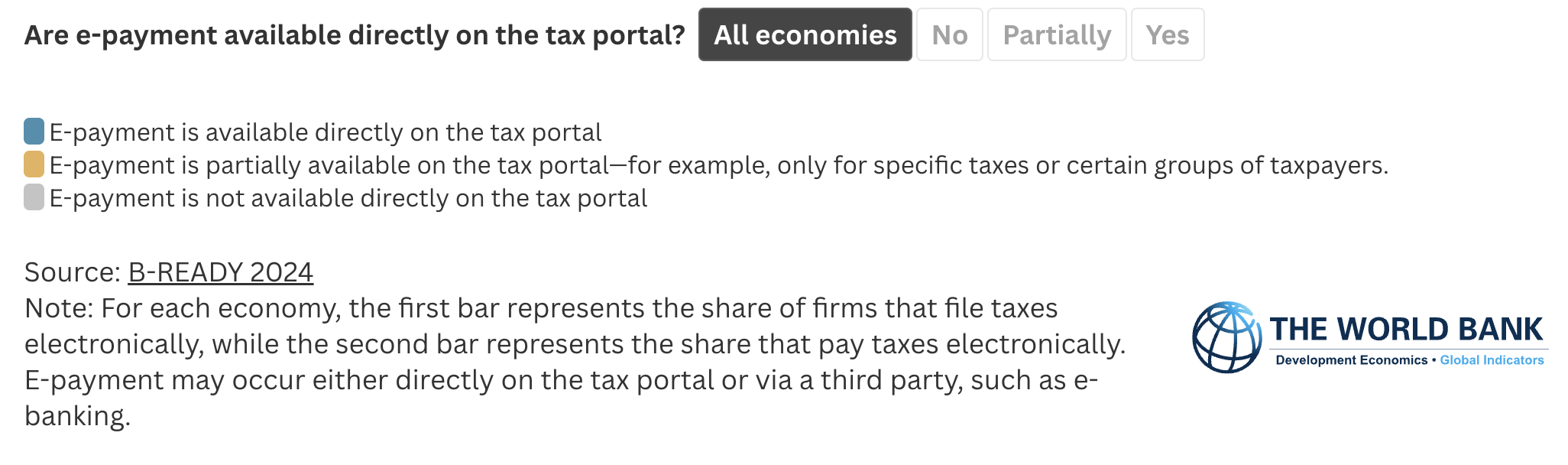

Allowing taxpayers to settle their tax liability directly through the portal enhances convenience by streamlining processes, eliminating the need for third-party navigation, and minimizing risk of manual data entry errors. Furthermore, such direct payments strengthen data protection.8 B-READY 2024 data show that most economies have implemented some form of taxpayer portal. However, the availability of direct e-payment on these portals varies widely.

Drawbacks of third-party online payment services

When direct e-payment is unavailable, taxpayers rely on third-party payment services or alternative methods, which can compromise the seamless user experience that direct e-payments are designed to provide.

While third-party services can act as temporary solutions—especially in regions where government portals are still developing—relying on external providers presents significant drawbacks. Private payment gateways can result in inconsistent user experiences, as service quality varies among different third-party providers, thereby also increasing the risk of human error when handling information. Further, the third-party providers may have unique requirements such as setting up a separate account or requiring additional documents as part of user verification.9 Additionally, managing sensitive data across multiple platforms increases security vulnerabilities, as not all providers implement stringent security standards.10

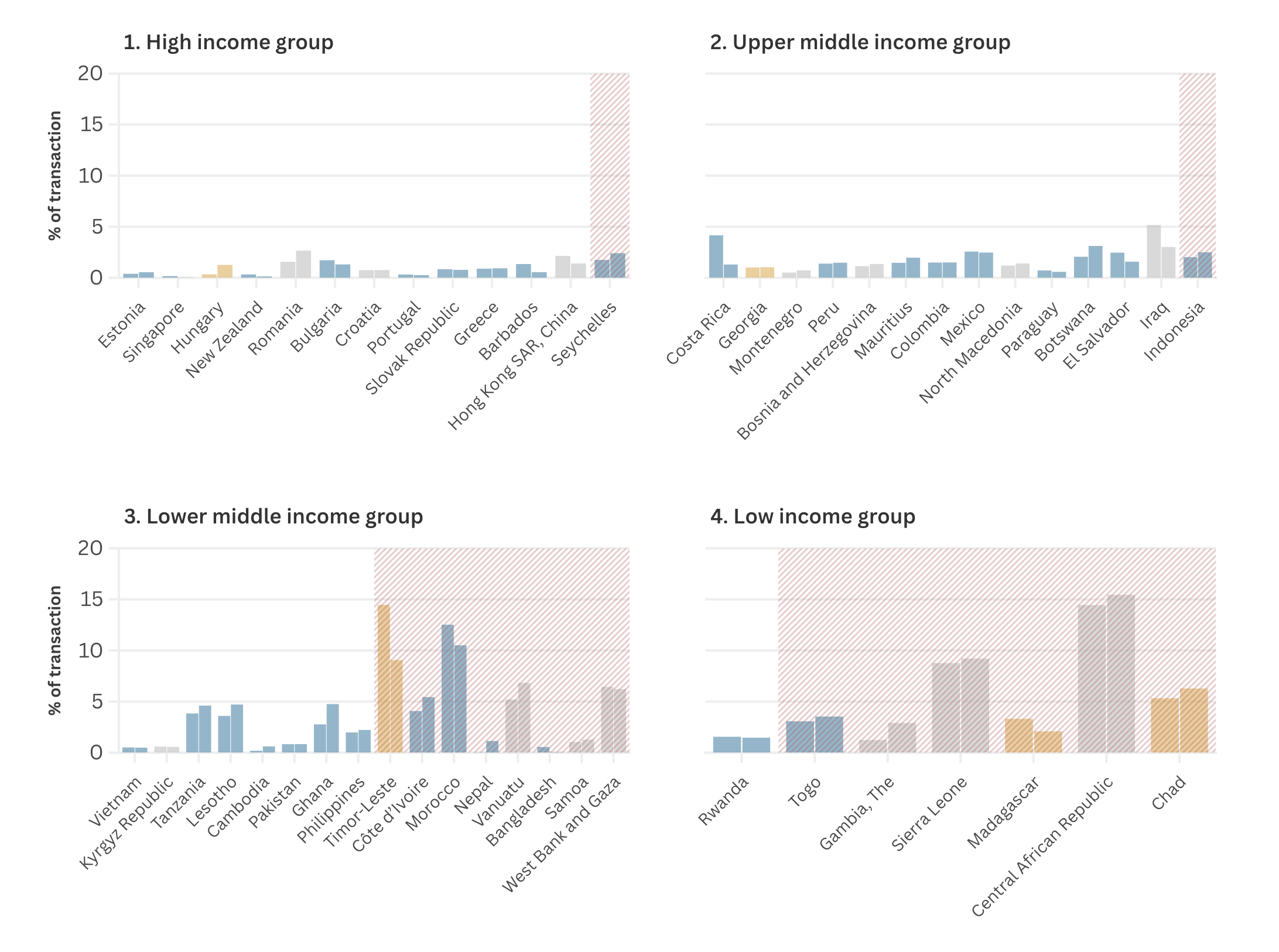

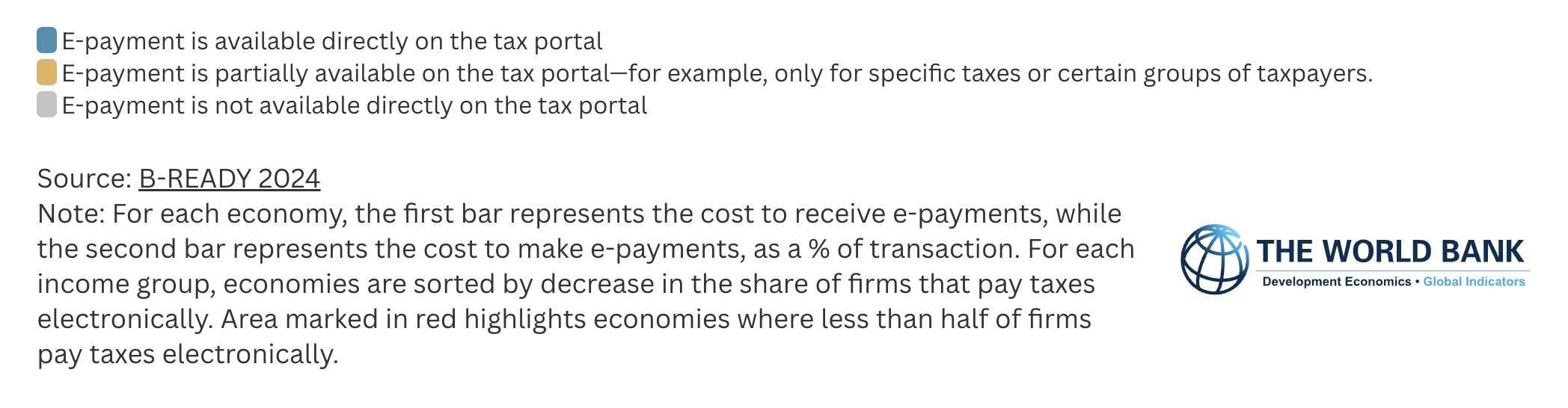

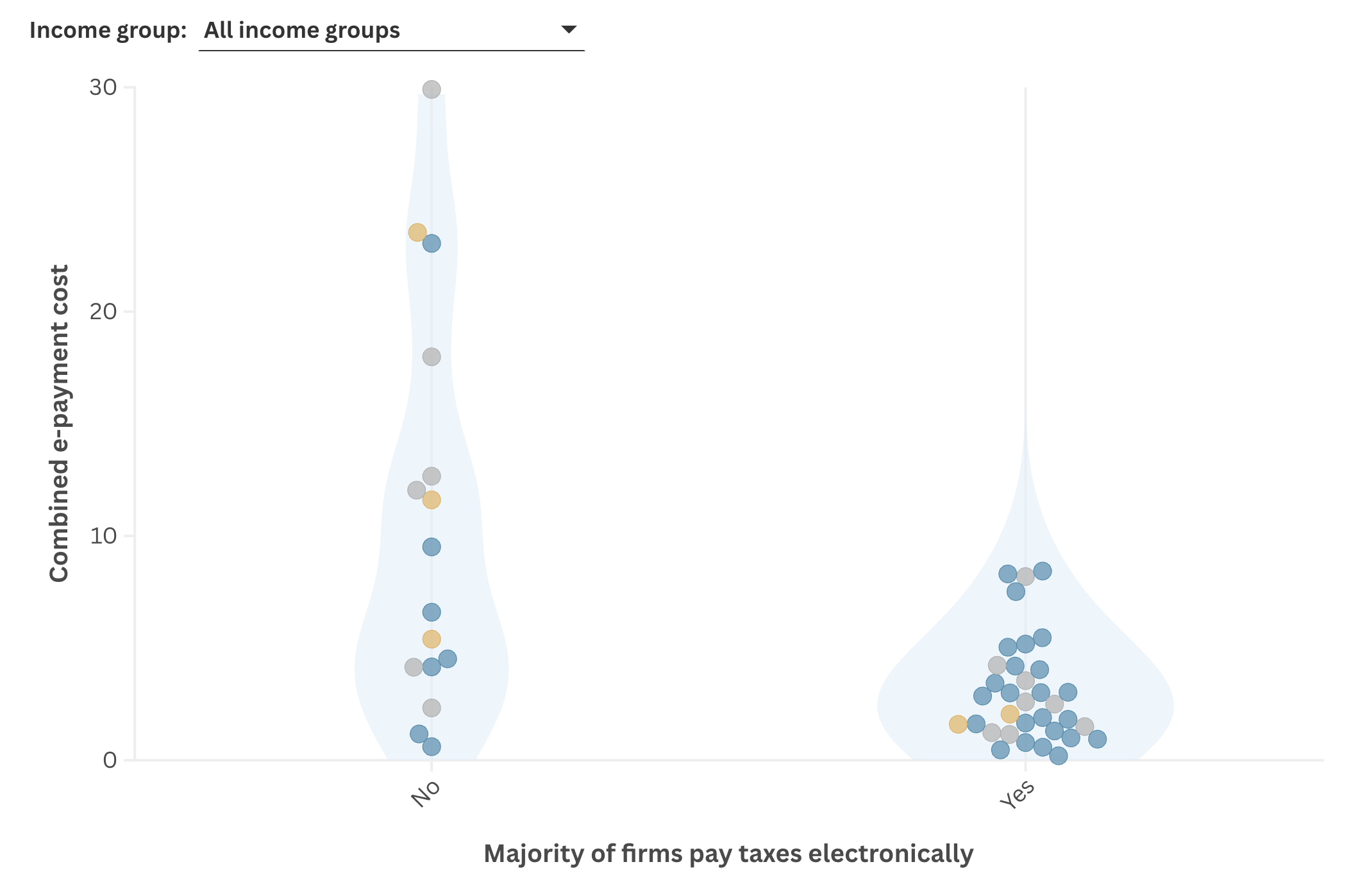

Finally, the use of third-party platforms may trigger additional costs.11 Figure 2 shows the variation of general e-payment costs across the economies and income groups. Firms in lower-middle- and low-income economies face significantly higher costs compared to their peer in high- and upper-middle income economies. When these data are considered alongside e-payment adoption for taxation (Figure 3), a clear pattern emerges: economies with high uptake of e-payments for taxes tend to have lower cost of e-payments in general.

Figure 2: Cost to receive and make e-payments

Figure 3: Cost of general e-payments compared to the uptake of e-paying taxes

Online tax portal and e-payment systems optimize tax collection by making the process more efficient, transparent, and secure. When taxes are paid electronically through tax portals directly, taxpayers benefit from reduced compliance costs, enhanced security with robust measures, and real-time updates to tax records, compared to e-payments made through third parties. Although third-party platforms can serve as temporary solutions, they often add fees, complexities, and security risks, undermining efficiency and convenience. By integrating e-payments in tax portals, governments can create a more transparent and efficient tax enforcement, ultimately raising compliance rates and strengthening public revenue.

1 OECD. 2021. Building Tax Culture, Compliance and Citizenship: A Global Source Book on Taxpayer Education, Second Edition, November 2021. Paris: OECD Publishing. https://doi.org/10.1787/18585eb1-en.

2 Oyebola Motunrayo Okunogbe & Fabrizio Santoro. 2021. “The Promise and Limitations of Information Technology for Tax Mobilization.” Policy Research Working Paper No. WPS 9848, Washington, DC: World Bank.

3 Taxation data are collected through two methods: expert questionnaires and World Bank Enterprise Surveys (WBES).

4 Id.

5 Junquera-Varela, Raúl Félix; Lucas-Mas, Cristian Óliver. 2024. Revenue Administration Handbook. Washington, DC: World Bank Group. http://hdl.handle.net/10986/41090.

6 Kochanova, Anna; Hasnain, Zahid; Larson, Bradley. 2020. Does E-Government Improve Government Capacity? Evidence from Tax Compliance Costs, Tax Revenue, and Public Procurement Competitiveness. World Bank Economic Review. Oxford University Press on behalf of the World Bank. http://hdl.handle.net/10986/36073.

7 Junquera-Varela and Lucas-Mas, page 87.

8 Id., at page 85.

9 Malaguti, Maria Chiara; Delort, Dorothee; Lee, Carol. 2022. Legal Framework for Cybersecurity in the Financial Sector. Washington, DC: World Bank Group. https://documents1.worldbank.org/curated/en/099735005172232846/pdf/P1647700ca3dbe0b30a3680c806c4563a93.pdf

10 Okunogbe and Santoro, page 317.

11 Junquera-Varela and Lucas-Mas, page 54.