©Better Than Cash Alliance

The responsible and effective digitalization of tax payments has the potential to deliver major benefits for governments, businesses, and individuals.

For governments, digitalization can lead to cost savings by improving administrative efficiency and operational productivity, increasing net revenue.

As Dr. Vera Songwe, Under-Secretary-General of the United Nations Economic Commission for Africa, highlighted during the Pan-African Peer Exchange, tax digitalization holds immense potential for economic recovery from the pandemic: “Digitizing tax payments and related processes can raise additional resources for African governments to fight COVID-19 and help move the countries back to growth”.

For taxpayers, digitalization can reduce voluntary compliance costs, and boost trust and confidence through greater transparency and accountability.

In 2019, the Alliance investigated Success Factors in Tax Digitalization in three countries (Indonesia, Mexico, and Rwanda) digitalizing their tax administration systems to increase domestic revenue.

48% the Mexican government saw a 48 percent increase in tax revenue by streamlining revenue collection

– SHARE

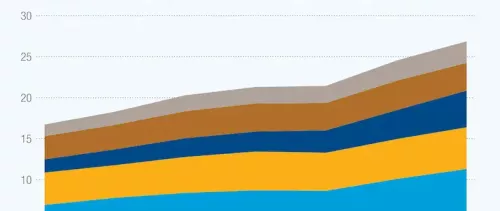

One key observation was that in many countries small and micro merchants are often reluctant to engage with digital payments due to fear of taxation. We connected this research to an Alliance-led Working Group on Merchant Payments Digitization in Mexico. This working group built on the efforts of the Mexican government to streamline revenue collection, including mandatory e-invoicing between 2012 and 2017, driving a 48 percent increase in tax revenue from goods and services. This increased the tax-to-GDP ratio from 12.6 percent in 2012 to 16.5 percent in 2019.

In Indonesia, the Directorate General of Taxes promoted digitalization to encourage taxpayer compliance, achieving a 20 percent reduction in business tax compliance time between 2014 and 2019. In Rwanda, tax reforms combined with investments in digital tax services between 2010 and 2020, increased the tax-to-GDP ratio from 13.1 percent to 15.9 percent and led to 14 percent average annual growth in revenue collected from 2010 to 2018.

India is also embracing digital transformation in tax collection. Having implemented arguably the largest-scale tax reform with the introduction of the Goods and Service Tax, the Government is now pioneering “stack” infrastructure, defined by its interoperability and building on Aadhar, the national unique identification system.

Achieving this success was neither easy nor smooth. Three key learnings emerged:

- Invest in a strong and resilient foundational tax system

- Embrace a comprehensive change management program

- Forge private sector partnerships and leverage data for better service delivery

A shared vision for tax digitalization is important in establishing an effective, user-centric tax system, so supporting regional and municipal tax authorities in their digitization journeys is essential. Institutions involved may have varying levels of digital maturity, so providing tailored support is also key to obtaining commitment from all.

While payments are just one component of the highly complex end-to-end tax collection process, tax digitalization – when designed and implemented effectively – has the potential to deliver major benefits for society, reduce inequalities, and contribute to the financing of the SDGs.