The South Centre, the Malaysian Tax Academy (MTA) and the Permanent Mission of Malaysia to the UN in Geneva co-organized from 24-26 May 2022 a capacity building program for Malaysian tax officials on the OECD Inclusive Framework’s solution for the taxation of the digitalized economy, known as Pillar One. The first two days were closed for Malaysian tax officials and the third day was opened to tax officials from the Group of 77+China. The latter addressed the topic of dispute prevention and resolution which is of interest to many tax administrations. The training was provided by tax officials from the Government of India, experts from the International Lawyers Project and the staff of the South Centre.

The peer exchange capacity building program came at the right time, as per the participants. The OECD’s proposed solution for taxation of the digital economy, known as Amount A of Pillar One, will be codified into a multilateral convention and submitted to countries for signature. Hence, all countries who are members of the Inclusive Framework, in particular developing countries, require a deep understanding of the complex rules of Pillar One so as to allow them to make a right decision.

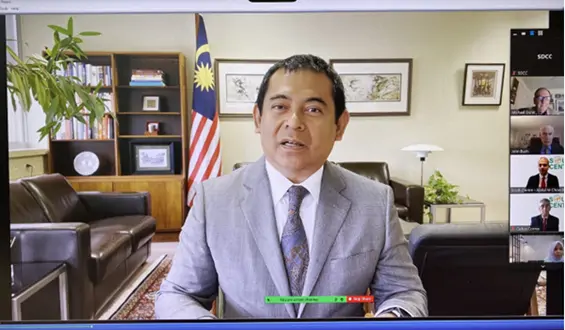

The program began with welcoming remarks by H.E. Mr. Ahmad Faisal Muhamad, Permanent Representative of Malaysia to the United Nations in Geneva, and Prof. Carlos Correa, Executive Director of the South Centre, followed by opening remarks by Ms. Zinatul Ashiqin Bachek, Director of the International and Professional Training Centre at the Malaysian Tax Academy.

H.E. Mr. Ahmad Faisal Muhamad, Permanent Representative of Malaysia to the UN in Geneva

H.E. Mr. Ahmad Faisal Muhamad recalled that the COVID-19 pandemic has accelerated the advancement of technology, enabling business to operate and generate profit in jurisdictions in which they have limited or no physical presence and diminishing their taxable profit as well. Furthermore, the Ambassador highlighted the fact that globalization has changed the way businesses are conducted and raised new challenges to the traditional mechanisms of taxation thereby depriving certain jurisdictions of tax revenue. In that regard, he commended the South Centre’s capacity building program as a platform for international and local experts to share their knowledge, views and experiences on the latest developments concerning taxation, including the OECD Two-Pillar solution.

Prof. Carlos Correa, Executive Director of the South Centre

Prof. Carlos Correa, after recalling the three pillars of the South Centre work which are i) providing policy-oriented research, ii) supporting developing countries in international negotiations, and iii) providing technical assistance and training, highlighted the fact that taxation has become a very important area of work of the South Centre due to the need for developing countries to mobilize resources for the Sustainable Development Goals, the impact of the digital economy, and the ongoing reform process of the taxation system at the OECD with the Two-Pillar solution.

Ms. Zinatul Ashiqin Bachek, Director of the International and Professional Training Centre at the Malaysian Tax Academy

Ms. Zinatul Ashiqin Bachek gave her acknowledgement to H.E. Mr. Ahmad Faisal Muhamad and Prof. Carlos Correa for their welcoming remarks, thanked the South Centre Tax Initiative (SCTI) and the Malaysian Tax Academy (MTA) for the preparation of the virtual session, and expressed her appreciation to all the participants for their interest in the program.

On the first day of the program, the participants were taken through the rules on the scope, nexus and revenue sourcing. These would outline the process of identifying an in-scope Multinational Enterprise (MNE) and the process of sourcing its revenue to countries or jurisdictions.

On the second day, the discussion focused on the determination of the tax base, the calculation and the distribution of the re-allocable profit under Amount A rules, and the mechanism for elimination of double taxation.

On the third day, as noted, the program was opened to tax officials from the G-77+China. It covered the tax certainty mechanism for Amount A and the mutual agreement procedure.

The main issues addressed were as follows:

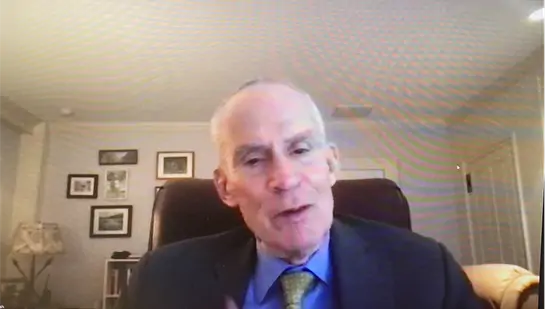

The training started with a historical background by the International Lawyers Project to the issue of the digitalization of the economy, the tax challenges arising from that digitalization and the adoption of unilateral measures by countries. John Bush, Program Director for Tax and Fiscal Reform at the International Lawyers Project (ILP), and Michael Durst, Special Advisor for Fiscal Reform at the ILP, provided an overview on the scope rules for Pillar One, such as the revenue thresholds, profit margin, and the exclusions.

Mr. John Bush, Program Director for Tax and Fiscal Reform, International Lawyers Project (ILP)

Mr. Michael Durst, Special Advisor for Fiscal Reform, International Lawyers Project (ILP)

After the International Lawyers Project’s presentation, the scope rules were elaborated further by participants from the Central Board of Direct Taxes (CBDT), India. Mr. Chetan Rao, Director of the Foreign Tax and Tax Research at the CBDT, Ms. Vidyotma Singh, Deputy Commissioner, Foreign Tax and Tax Research Division at the CBDT, and Mr. Sukhad Chaturvedi, Under Secretary, Foreign Tax and Tax Research Division at the CBDT, highlighted the exclusions relating to extractive activities and regulated financial services. They also pointed out the concerns of developing countries regarding these rules.

The second day started with presentations from the CBDT of India and the ILP on the nexus and revenue sourcing rules in Pillar One. The presentation by Dr. Sri Vatsa Sehra, Under Secretary, Foreign Tax and Tax Research at the CBDT, provided details on the rules to be used in identifying the source of MNE revenue in the different market jurisdictions. The different categories of revenues such as finished goods, components, services, etc., and the allocation rules per revenue category were presented.

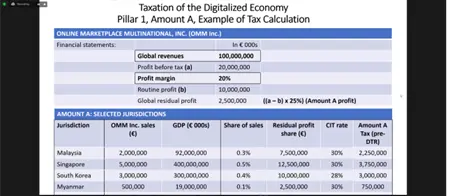

This was followed by Mr. Bush and Mr. Durst (ILP), who focused on tax base determination and profit allocation. The participants were provided practical examples on the process of calculation and allocation of Amount A to the market jurisdictions, especially the computation of the profit before tax, the residual profit, and the re-allocable profit. The session ended with a presentation on elimination of double taxation mechanisms provided by both the CBDT, India and the ILP.

Example of tax calculation for how much countries would receive under the OECD solution

The third day’s session was opened to tax officials from the Group of 77+ China. It began with welcoming remarks from H.E. Mr. Ahmad Faisal Muhamad, Permanent Representative (PR) of Malaysia to the United Nations in Geneva. He wished that the session will provide an opportunity for intensifying efforts and cooperation on issues that are still under discussion. The PR also noted that it is vital for all of us to work together and galvanize our resources, share our knowledge and expertise in this field so as to minimize the potential risks of revenue losses arising from Amount A related dispute resolution. The program then focused on the dispute prevention and resolution mechanisms in Pillar One with presentations from India’s CBDT team and the South Centre.

Mr. Abdul Muheet Chowdhary, Senior Programme Officer, South Centre Tax Initiative

Mr. Sebastien Babou Diasso, Research Consultant – Tax, South Centre Tax Initiative

The session provided details on the functioning of the tax certainty process. It was of particular importance as for the first time in history, a multilateral structure was envisaged to resolve tax disputes. Hence, the training sought to equip participants with knowledge of how the system was meant to function, as well as the risks involved for developing countries.

The presentation of the South Centre made by Abdul Muheet Chowdhary and Sebastien Babou Diasso focused on some recommendations to improve the design of the tax certainty framework and preventive measures which developing countries could take to prevent disputes from arising. Data was also provided on which countries would be affected by the mandatory binding mechanism.

The last topic of the day was related to the Mutual Agreement Procedure (MAP), presented by India’s CBDT team. The MAP process assumed relevance as if it could not resolve disputes within a stipulated time frame, the disputes would be taken to the multilateral dispute resolution framework. Hence, more effective use of MAP could reduce the number of disputes going to this framework and retain national sovereignty over the process. The CBDT team provided information on the MAP process, the implementation guidance and lessons learnt through experience which could be helpful for other developing countries.

Mr. Fernando Rosales, Coordinator, SDCC Programme, South Centre

The three-day capacity building programme ended with closing remarks made by the Coordinator of the Sustainable Development and Climate Change (SDCC) programme of the South Centre, Mr. Fernando Rosales.