Households and small businesses in Ukraine will have improved access to digital financial services thanks to the support of IFC, a member of the World Bank Group, and the Ukrainian Association of FinTech and Innovation Companies (UAFIC), who, together, aim to promote financial inclusion in the country.

According to the Government of Ukraine, increasing the uptake of financial services, while protecting consumer rights and improving financial literacy, are key strategic goals for the nation. Ukraine aims to increase non-cash transactions as a share of the total volume of transactions from 49 percent in 2019 to 65 percent over the next five years.

To support these efforts, IFC, in partnership with the Swiss State Secretariat for Economic Affairs SECO and the U.K. Government's Good Governance Fund, will be working with the UAFIC, the country's largest non-governmental organization focused on the national financial technology market and fintech ecosystem. IFC's experts will help the association establish a public-private dialogue process to evaluate opportunities for a digital marketplace— an e-commerce platform that brings sellers and buyers together in one place.

"In the past year, both fintech firms and banks have realized that being part of open banking technologies is more advantageous than competing against each other," said Rostyslav Dyuk, Chairman of the Board at UAFIC. "The financial ecosystem is accepting new signals for open, collaborative partnerships on the market. Open banking will bring banks and fintech firms to a platform model where they can share customer data and develop new products through Application Programming Interfaces."

The partnership will also help promote legal and regulatory reforms that can make higher-quality financial services more accessible for Ukrainians. One of those initiatives is Open Banking, a practice that provides third-party financial service providers, such as tech start-ups and online financial service vendors, access to financial data of customers in a secure and convenient manner, under conditions that customers grant approval for. The efforts are expected to contribute to the State Strategy of Ukrainian Financial Sector Development, which aims to ensure that 80 percent of payment services providers work in Open Banking by 2025.

"Innovative technologies are reshaping the banking industry in many countries. Digital transformation and access to affordable digital financial services is critical for Ukraine's economic growth and resilience in a post-COVID world," said Jason Pellmar, IFC Regional Manager for Ukraine, Belarus, and Moldova. He added, "Building on our extensive global experience, IFC will help Ukraine create a competitive environment for the uptake of essential digital financial services."

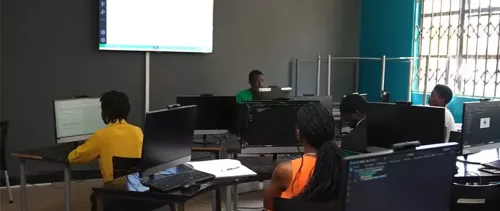

Under the new agreement, IFC and UAFIC will also design a financial literacy toolkit for SMEs and support a series of knowledge-sharing trainings to help create an efficient and vibrant fintech market.

The initiative is part of IFC's four-year Financial Inclusion for Growth Project, implemented in cooperation with the National Bank of Ukraine, Ministry of Finance and Ministry of Digital Transformation, aimed to leverage digital technology and innovative business models to advance financial inclusion.

About IFC

IFC—a member of the World Bank Group—is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2020, we invested $22 billion in private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity. For more information, visit www.ifc.org.