Digital financial services are fundamentally changing the way consumers manage, save, spend, and borrow money. In a fast-moving, innovation-driven sector, we can expect this to continue in the years ahead.

So far, many of these innovations have been transformative, helping millions of people around the world to reap the benefits of financial inclusion, empowerment, and independence for the first time. However, digitalisation has also brought with it new and heightened risks for consumers. These include over-indebtedness, exposure to scams and fraud, data breaches, and more – with particular risk for low-income and vulnerable consumers.

In 2022, at the Fair Digital Finance Forum, we unveiled our vision for fair digital finance: a world where digital financial services are inclusive, safe, data-protected and private, and sustainable. Since then, we have monitored the consumer experience of digital financial services in low- and middle-income countries, identifying gaps and tracking progress over time.

Today, Consumers International publishes its annual financial sector index, ‘Digital finance: The consumer experience in 2024’, providing an assessment of the state of digital financial services in low- and middle-income countries.

In its second year, this offers a unique perspective, derived from the vantage point of consumers themselves. It emphasises the need for a mindset shift in the sector, greater collaboration, and the critical role of consumer organisations in driving this change.

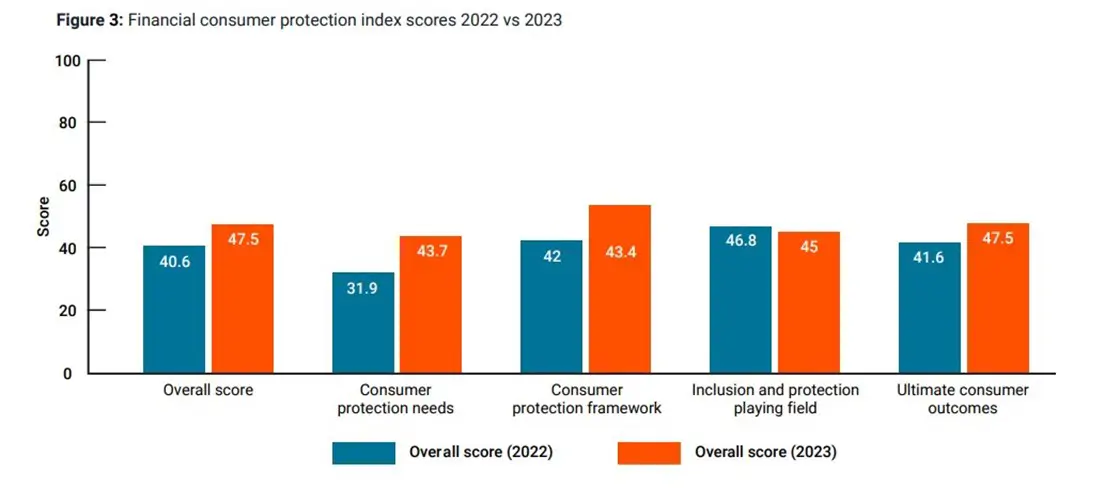

Assessed across four ‘pillars’ of financial consumer protection, the total index score comes in at 48 out of 100. This is an improvement from last year by an 8% increase – but the results make it clear that more work is needed to build consumer protection frameworks that sufficiently protect and empower consumers.

Spanish and French versions to be published in the coming weeks.

Key insights

Promising trends across the consumer protection frameworks and infrastructure

This year sees a promising rise in the overall index score from last year, from 41 to 48. The overall score rise is driven primarily by achievements in the development of digital financial service infrastructure and financial consumer protection frameworks.

However, progress is lagging where it matters most. The findings highlight gaps in financial resilience and fair customer outcomes, with poor scores related to lived experience and inclusivity. So although there have been regulatory and infrastructure improvements, these are not yet consistently translating into positive outcomes for consumers.

The consumer voice remains muted

Progress in consumer protection frameworks is held back by a lack of engagement with consumer bodies. Over the past year, we have seen a notable increase in the proportion of consumer bodies that have never been engaged with by central banks and other financial regulators. Without engagement, the collective consumer voice cannot be captured in policy-making and regulation.

Shifting mindsets towards a focus on consumer outcomes

The findings of the index point towards a need to shift mindsets to focus on consumer outcomes; assessing consumers’ financial health and building a comprehensive understanding of consumer sentiment. This means going beyond tick-box compliance and complaints monitoring. A holistic framework is called for, as well as a concerted effort to build financial and digital literacy. This will empower consumers as users of digital financial services.

Critically, transforming the consumer experience of digital financial services necessitates a joined-up effort among regulators, financial service providers, and consumer bodies.

Our call for an evolved consumer protection approach

This study constitutes a call to action to key marketplace actors. Together, we can realise our vision for fair digital finance.

For regulators

- To proactively consult consumer bodies when developing financial consumer protection policy and regulation.

- Re-orient regulation. Away from rules focused on market conduct. Towards consumer outcomes.

- Pave the way for a new approach to supervisory monitoring, evaluating outcomes for consumers on the ground.

- Scale up the monitoring and publication of complaints statistics.

For financial service providers

- To pioneer a culture of fair customer treatment.

- See consumer complaints as a key source of intelligence from which to build better, more inclusive services.

- Measure good consumer outcomes. Track how they translate to better business performance and risk management.

For consumer bodies

- To shift the mindset of regulators and financial service providers towards an outcomes-oriented approach.

- Champion the unique value of the consumer perspective.

- Stay close to the realities of consumers’ financial lives. Keep a finger on the pulse of emerging risks and trends.

- Address the engagement gap on climate resilience and sustainable finance.

The Fair Digital Finance Accelerator

These insights are a contribution to the work of Consumers International’s Fair Digital Finance Accelerator.

As evidenced by the index, consumer bodies play a vital role in shifting mindsets to focus on consumers’ real financial lives. To help them take up the charge, the Accelerator brings together consumer associations in low- and middle-income countries. Through grants, training and thought leadership, it builds their capacity to connect with market players and regulators, and to reach and represent the collective consumer voice.

To date, the Accelerator has trained over 90 consumer advocacy organisations and its efforts have reached more than 100,000 consumers through awareness and education initiatives. It has extended sub-grants to eight consumer bodies in seven countries to ramp up their work understanding and acting on consumer needs.

To learn more visit Fair Digital Finance Accelerator

To join or support our vision, contact [email protected].

An innovative tool endorsed by fair digital finance leaders

“The Fair Digital Finance Index brings a critical lens on the consumer and is a great reminder to us, digital financial service providers and policymakers, that we must keep the consumer at the centre of what we do.

As an ecosystem striving to reach all with life-changing digital financial services, we must regularly monitor that we are achieving this by reaching all – including the most vulnerable – in a safe way that leads to greater financial health.

As the GSMA, we are excited to have this tool in our toolbox for this very purpose.”

Ashley Onyango, Head of Financial Inclusion, GSMA

“With the launch of the second edition of the Fair Digital Finance Index, it is heartening to see the progress in regulatory frameworks, and the fact that digital financial services inclusion is supported by strong infrastructure.

However, that is not enough. We want to see more inclusivity for vulnerable groups, and a better lived experience for consumers – more day to day usage, better trust through positive experiences and, ultimately, better financial wellness outcomes. We also want to see more engagement of consumer bodies to help shape market and regulatory outcomes.

This is a strong call to action that the Fair Digital Finance Accelerator is well placed to heed.”

Christine Hougaard, Technical Director, Cenfri

“While the report by Consumers International recognises progress in consumer protection, it also underscores the importance of customer centricity and collaboration among key stakeholders.

At CGAP, we believe that involving consumer associations and representatives is crucial for the development of a responsible digital finance ecosystem that empowers consumers and enhances their resilience.”

Eric Duflos, Consumer Protection Lead, Senior Financial Sector Specialist, Consultative Group to Assist the Poor (CGAP)

RELATED NEWS

13 January 2025

3 ways to make digital finance more inclusive for all consumers