Vidyasagar Setu bridge in Kolkata, West Bengal, India. (Image: Sauvik Bose via Unsplash)

Embedding digitalization as part of the wider industrialization strategy can enable developing country firms to climb up the value chain ladder.

It has been well-established in economics literature that a country’s economic long-term growth depends not only on how much it exports but also what it exports.1 Increases in product sophistication advance the technological frontier of a country and improve its growth performance, enabling the country to climb up the export value chain, thereby driving economic development.2 Product upgrading has emerged as a key strategy for capturing higher value addition in global value chain (GVC) literature as well.

Linking into GVCs can be an important driver of product upgrading; firms benefit from access to cheaper and better quality imported inputs, and learn from the knowledge and technology embedded in imported intermediates, as evidenced in the case of Indian firms.3 They also have higher incentives to innovate as a result of access to international export markets, as the case of Italian firms demonstrates.4 A firm involved in both importing and exporting products can create cost complementarities, which can have a positive impact on product scope, the introduction of new products and product sophistication.5 Some studies propose combining the top-down approach of upgrading in GVCs with the bottoms-up approach of technological capabilities.6 The internationalization of Italian firms, for instance, did not necessarily lead to good performance, as both international presence and innovation efforts in terms of product, processes and technologies are essential elements of global competitiveness. Firms that achieve gains in terms of profit and growth are those that invest in R&D, codified knowledge, design and innovative information and communications (ICT) solutions.7

Digitalization and upgrading in GVCs

Digital capabilities can be thought of as a subset of wider technological capabilities for acquiring, absorbing and adapting technology. This can include capabilities in terms of ‘hard’ digital infrastructure, such as investments in computers, Internet of Things (IoT) sensors, routers and other physical ICT infrastructure, and ‘soft’ digital infrastructure, such as the use of software, cloud-computing, intellectual property, networking capacity, etc. Overall, investment in digital capabilities can open new opportunities for developing country firms to reduce their production and transaction costs8. Emerging case studies have unearthed different channels through which digital technologies are impacting product upgrading.

Digital technologies reduce the product development timeline and costs, which can lead to digital engineering and subsequent improvements in pre-manufacturing stages, such as R&D and design. For example, Panessar Interiors, a Kenyan furniture manufacturing firm, is using auto CAD design software, which enables the creation and presentation of 3D designs for customers, allowing for easy revisions and changes to designs and the customization of doors and drawers.9

The digitalization of manufacturing increases firm efficiency and cost savings which can be reinvested into improving product quality and moving into more sophisticated product lines. For example, Hyundai Motors India Limited and Mahindra and Mahindra initially specialized in the manufacturing of commercial and utility vehicles, but later developed capabilities to serve the passenger car segment by investing in digital technologies, which enabled the production of higher output without major changeover costs, faster delivery time, and higher quality.10

Digital technologies reduce the costs of exchange and trade through intermediation by digital platforms, including business-to-business (B2B) and business-to-consumer (B2C) e-commerce. Firms can now more easily source inputs online and at more competitive rates. For instance, in Cambodia, e-commerce has enabled the shift of production from cereals towards higher value-added products such as fresh mangoes and cashew nuts.11

Market-related sales data can be used for product design and development, which may help firms enter into new products and sectors in a targeted manner. Firms that control these data and possess the required analytical capabilities can identify the heterogeneity of demand patterns both between and across developed and developing country markets and are thus able to undertake targeted product development accordingly.12

In addition to digital capabilities, suppliers’ managerial capabilities also matter for reaping the benefits of the digital economy. Digitalized products tend to involve very complex knowledge that is highly tacit in nature and difficult to codify into standards and blueprints.13 When knowledge is tacit, passive learning by suppliers (i.e. by using capital goods or through technology embedded in FDI) may not be sufficient to acquire technical knowledge, and in such cases, suppliers will need to make increased investments in skills development.

Evidence from Indian manufacturing

India makes for an interesting case – numerous initiatives have been taken by the government to digitally transform India under the ‘Digital India’ programme. While India ranks high in terms of digital services exports compared to other countries, it lags behind not only developed countries, but also many developing economies in terms of digital preparedness in manufacturing trade, including in its traditional export sectors.14

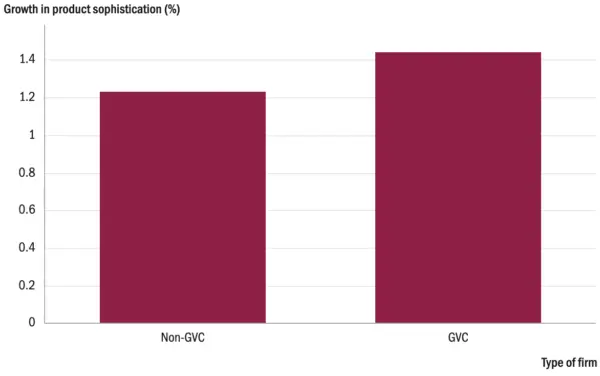

Whether digital capabilities and skills development are driving product upgrading in Indian GVC firms is explored using panel data of manufacturing firms from Prowess database for the period 2000/01–2014/1515. GVC firms are defined as those that simultaneously import and export intermediate goods, while Hausmann et al.’s PRODY index is used to calculate product sophistication.16 Higher product sophistication gains from linking into GVCs are evident for Indian manufacturing GVC firms (figure below). The average annual growth in firm-level product sophistication is significantly higher in GVC firms (two-way traders) than in non-GVC firms (domestic firms and one-way traders).

Growth in product sophistication across GVC and non-GVC firms (2001–2015), in %

Note: Using the t-test, we find that that there is a statistically significant difference in the means of growth in product sophistication across GVC and non-GVC firms at 5 per cent. Growth is calculated as change in log product sophistication. The average sales-weighted firm product sophistication index is constructed by matching product-firm data in Prowess with trade data in UNCOMTRADE.

Source: Author, constructed from Prowess.

An empirical analysis of the sub-set of GVC firms finds that firm-level digital capability has a positive and significant effect on product sophistication, on average and all else equal, implying that as GVC firms spend a larger share of their sales on software, technology and communication assets, their product sophistication rises. Hence, by investing in digital capabilities, firms can upgrade to more sophisticated product lines that capture higher value added in GVCs. The share of skilled labour is also found to have a positive and significant impact on firm sophistication, suggesting the important role a well-skilled manufacturing workforce plays in producing more sophisticated goods.

Indian GVC firms that belong to more concentrated industries are producing more sophisticated goods, indicating that manufacturing industries that are more concentrated generate larger profits for firms, which can be reinvested to create more sophisticated product lines. Interestingly, younger Indian GVC firms are more sophisticated; while older Indian firms are likely to hold greater market power and the ability to innovate, it is the younger firms that have more incentives to innovate and remain competitive. The survival and growth of younger firms may depend more heavily on product innovation and the manufacturing of more sophisticated goods. No significant impact of foreign shares or foreign acquisition is found on firm-level product sophistication, perhaps due to cost-saving strategies pursued by foreign investors in India. Yet they invest in Indian firms to produce less sophisticated, low-cost goods, which are then exported to the foreign investor’s home country.17

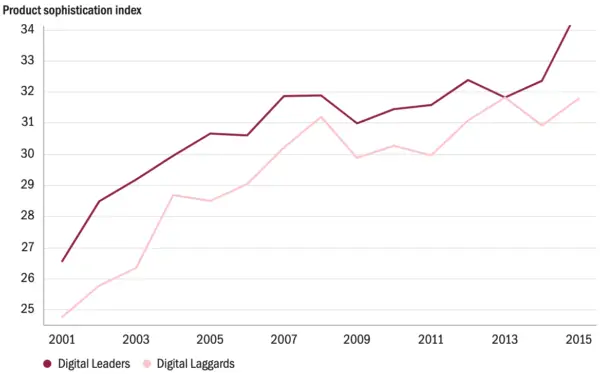

Indian GVC firms that are digital leaders, i.e. that have both a digital capability index and skill level above the median industry level have a 4.5 per cent to 5.5 per cent higher product sophistication, on average and ceteris paribus, compared to digital laggards, i.e. firms in which both the digital capability index and skill level is below the median industry level. Product sophistication among digital leaders has in fact remained consistently higher than among digital laggards (figure below).

Product sophistication index in GVC firms

Note: Digital leaders are categorized as firms with a digital capability index and skill level above the median industry level. The digital capability index is constructed using Principal Component Analysis on the share of the firm’s software, technology and communication assets in its total sales. Skill level captures the share of managerial remuneration in total labour compensation.

Source: Author, based on Prowess data.

Disclaimer: The views expressed in this article are those of the authors based on their experience and on prior research and do not necessarily reflect the views of UNIDO (read more).

References

- Jarreau, J. and S. Poncet (2012). Export sophistication and economic growth: Evidence from China. Journal of development Economics, 97(2), pp.281-292.

- Hausmann, R., J. Hwang, and D. Rodrik (2007). ‘What You Export Matters’. Journal of Economic Growth, 12(1): 1–25.

- Goldberg, P.K., Khandelwal, A.K., Pavcnik, N. and Topalova, P. (2010). Multiproduct firms and product turnover in the developing world: Evidence from India. The Review of Economics and Statistics, 92(4), pp.1042-1049.

- Bratti, M. and Felice, G. (2012). Are exporters more likely to introduce product innovations?. The World Economy, 35(11), pp.1559-1598

- Lo Turco, A. and Maggioni, D. (2015). Imports, exports and the firm product scope: evidence from Turkey. The World Economy, 38(6), pp.984-1005

- Pietrobelli, C. and Rabellotti, R. (2011). Global value chains meet innovation systems: are there learning opportunities for developing countries?. World development, 39(7), pp.1261-1269.

- Chiarvesio, M., Di Maria, E. and Micelli, S. (2010). Global value chains and open networks: the case of Italian industrial districts. European Planning Studies, 18(3), pp.333-350.

- Banga, K. (2021). Digital Technologies and Product Upgrading in Global Value Chains: Empirical Evidence from Indian Manufacturing Firms. The European Journal of Development Research.

- Banga, K., and D. W. te Velde (2018). ‘How to Grow Manufacturing and Create Jobs in a Digital Economy: 10 Policy Priorities in Kenya’. Report. London: Overseas Development Institute.

- Ray, S., and S. Miglani (2018). Global Value Chains and the Missing Links: Cases from Indian Industry. New Delhi: Routledge India

- ITC (2018). What Sells in E-Commerce: New Evidence from Asian LDCs. Geneva: International Trade Centre.

- Mayer, J. (2018). ‘Digitalization and Industrialization: Friends or Foes?’. Research Paper 25. Geneva: UNCTAD.

- Andrews, D., Criscuolo, C. and Gal, P. (2016). The global productivity slowdown, technology divergence and public policy: a firm level perspective. Brookings Institution Hutchins Center Working Paper, 24.

- Banga, R. (2019). ‘Is India Digitally Prepared for International Trade?’. Economic and Political Weekly, 54(5).

- At the country level, the existing literature has proxied the extent of digitalization through different indicators, including robot density, e-commerce growth, digital servicification of manufacturing and internet penetration. At the firm level, particularly for Indian manufacturing firms, data on the use of digital technologies, robotics, and e-commerce are not available. Therefore, the study measures digital capability at the firm-level, using information on (1) communication and transport infrastructure; (2) technology assets, which refers to gross plant, machinery, computers, and electrical installations; and (3) software assets of the firm.

- Hausmann, R., J. Hwang, and D. Rodrik (2007). ‘What You Export Matters’. Journal of Economic Growth, 12(1): 1–25.

- Eck, K., and S. Huber (2016). ‘Product Sophistication and Spillovers from Foreign Direct Investment’. Canadian Journal of Economics, 49(4): 1658–84.

- Foster, C., M. Graham, L. Mann, T. Waema, and N. Friederici (2018). ‘Digital Control in Value Chains: Challenges of Connectivity for East African Firms’. Economic Geography, 94(1): 68–86.