- Salama Drichiru, a Digital Community Entrepreneur in Yumbe, demonstrates to VSLA members how to access a digital loan. | Photo by: UN News/ Hisae Kawamori

UNCDF

- |

Bridging the informal-formal divide in financial services – How going digital is linking the two worlds in access to finance in rural Uganda

Richard Ndahiro, Technical Advisor – Fintech & Inclusive Finance, UNCDF

Fiona Luswata, Digital Finance and Innovation Analyst, UNCDF

The formal-informal divide is deeply entrenched in service provision across many economic sectors. Most economic systems and institutions are designed to serve the formal sector -and the expectation is that citizens must cross the border from ‘informal land’ to ‘formal land’ for them to count and get served. Service providers often mention the high cost and risk of reaching those living in informal land, while on the other hand, customers decry the prohibitive requirements and costs involved in moving to ‘formal land’. The informal sector employs by far the largest share of the population, estimated at 85% in Sub-Saharan Africa and 75% in Uganda. The need for systems and solutions to serve the informal sector cannot be disputed.

The informal-formal divide runs deep in the financial services sector. Several financial inclusion interventions are geared towards getting citizens to cross the border from informal to formal land. Digital financial services – notably mobile money and agency banking – have in a way eased this transition for both the providers and users of financial services. For example, over the last decade of mobile money across East Africa, we have seen formal financial inclusion figures double or even triple for some countries [1]. Even so, the use of informal financial services remains high, especially for saving and borrowing. In Uganda for example, while 71% of the adult population saves some form of money, only 39% save at a financial institution or on a mobile money account. For borrowing, while 77% of the adult population borrowed money, only 29% borrowed from a financial institution or through mobile money (Findex 2021). This stresses the role of informal financial service providers like Village Savings and Loan Associations (VSLAs), Rotating Savings and Credit Associations (ROSCAs), and Savings and Credit Co-operative Societies (SACCOs).

The role of informal financial services providers, especially in rural areas, is widely recognized. Various interventions, mainly by development partners, have gone into improving and strengthening the operations of these providers. One peculiar effort here has been linking VSLAs to formal FSPs (banks) – facilitating members of the VSLAs to cross from informal to formal land. This graduation process has had mixed results, in many cases seen as a way for banks to acquire new customers to the disadvantage of the VSLAs. A significant lesson learned in these linkage efforts has been that graduation to formal FSPs is hard to supercharge, but rather ought to take an organic growth path for the customer. For example, it has been demonstrated that rural finance providers have horned the art of using soft information (interpersonal relationships, borrower work capability, borrower experience and reputation, and peer pressure) to ensure lending safety. This type of information is hard to quantify and replace with legally binding requirements as used by typical formal FSPs.

With the acknowledgement that informal providers like VSLAs are a stronghold in providing rural financial services, however, several questions persist. For instance, how can we expose the VSLA members to the benefits and assets available in formal land without necessarily forcing the graduation of the members? These include access to a larger lending capital base to satisfy the borrowing needs of VSLA members, safer custody of members’ savings, and improved financial and operational management, among others; questions to which UNCDF is testing answers.

Fintech as an enabler of new linkage models: The case of Ensibuuko in Uganda

Digitizing VSLAs has gone mainstream as a means to secure member records and use the data to improve transparency and accountability within the groups and to eventually enable linkages and partnerships. As a model, the digitization of VSLAs is still majorly driven by development partners involved in rural financial inclusion. Ensibuuko is one of the leading tech companies that has been involved in digitizing VSLAs in Uganda since 2014. However, the value proposition of VSLA digitization has not moved beyond the safety of records. There is still no viable business model for tech-companies to scale digitization of VSLAs. Ensibuuko and other companies that have attempted the model of linking VSLAs to banks for a fee have not really seen success.

UNCDF and Ensibuuko pilot a fintech led – digital lending model for VSLAs

VSLAs rarely have enough savings to meet the borrowing needs of their members. While a potential solution is for some members to borrow from other lenders, (e.g., banks or MFIs), without the binding social collateral under the VSLA, they are regarded risky, and must go through prohibitive procedures to be accepted as customers of these institutions.

With historical data from VSLA digitization, it is possible to analyze the saving and lending patterns of VSLAs and their members. If a VSLA has been consistently taking member savings and seamlessly lending to its members, why wouldn’t the VSLA be trusted with more money to cover the borrowing needs of its members? With this insight, in 2021, UNCDF and FAO working with Ensibuuko explored building credit scores for VSLAs and their members and developed an end-to-end digital lending model.

Soon, however we encountered the trouble of partnering with a licensed FSP. The lending model built by Ensibuuko was based on partnering with a licensed FSP – as the official lender. Ensibuuko went on to explore partnerships with two different FSPs, but each one came with challenges. The FSPs were hesitant to fully trust an end-to-end digital lending model, without adding some manual checks by their loan officers (legacy systems and processes). The challenge with such manual processes is that they increase turnaround time and the cost of delivery and, therefore, the cost of lending to the VSLA.

To address this, Ensibuuko decided to do it alone and acquired a money lending license.

With the challenges in delivering the desired value proposition, the model was pivoted to have Ensibuuko lend directly. This meant building an in-house credit function, a challenging but feasible undertaking, if they started small and grew their portfolio with time. The confidence was also built on the fact that the model fully relies on the VSLA lending model – which is tested and trusted. However, came the challenge of the source of lending capital. As a fintech, starting a new model, access to lending capital was a challenge. UNCDF, working with FAO, approached the Uganda Development Bank (UDB) to structure a partnership -where UDB would provide wholesale lending to Ensibuuko, and the latter becomes the micro-lender to VSLAs. The proposal resonated with UDBs needs – keen to lend to the agricultural sector, yet not setup to offer micro loans. UDB was open to explore how a partnership with a fintech could enable them channel financing to smallholder farmers. While the structuring of this partnership took a while, it was eventually sealed.

100% pay-back rates highlights that the informal sector is being served

A pilot was launched in January 2022 in the sub-regions of West Nile, Acholi and Lango, and Kiryandongo district in Uganda. The lending was piloted with 15 groups that had received a positive credit score, each with a corresponding credit limit amount, and 190 individual farmers received loans. The loan product and terms are tied to the agriculture season – since the focus is on farmer VSLAs. The loan is bundled with Ag-insurance to cover crop failure. Six months later, 100% of the amount lent out had been paid back to Ensibuuko. In the following season, (October – November 2022), the portfolio tripled to 46 groups with 327 farmers receiving loans. Again, 100% of the money was fully paid back.

Armed with these results, Ensibuuko is now leveraging UDB financing to take the lending to the next level. Ensibuuko targets to grow the loan portfolio to five hundred million Ugandan Shillings using UDB funding. Other potential sources of lending capital are also opening up for Ensibuuko to scale the model.

What have we learned so far as we try to bridge the formal–informal divide?

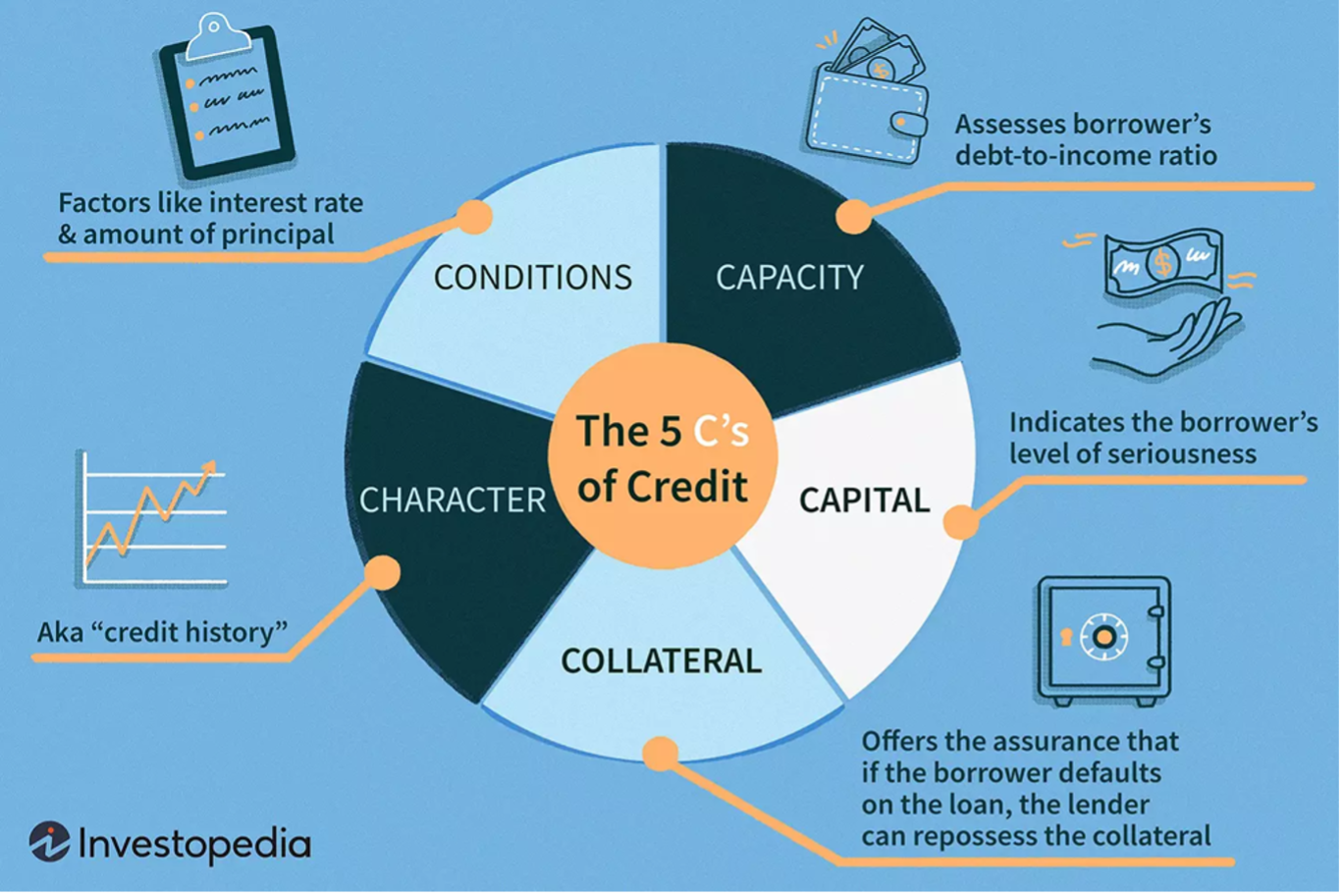

- That we need to re-think the 5Cs of credit (…and this is not news): Rural credit, especially to smallholder farmers, requires re-thinking the credit assessment. The classic 5Cs of lending does not work for informal, rural customers. Digital / fintech models are enabling new thinking and models in this regard.

Figure 1: Traditional 5 Cs of credit (Source: Investopedia) - We need to harness rural informal providers as viable last mile distributors of credit -linking formal to informal markets. Bypassing such providers as VSLAs might not be a viable solution in the near to medium term – at least if we are talking of rural informal markets. Formal FSPs seeking to penetrate rural markets ought to work out win-win partnerships with VSLAs – as last mile distributors of credit and not just for referrals. In the current pilot, while UDB has experience in delivering financial and non-financial solutions to enterprises particularly large and medium size agri-businesses, they needed alternative innovative ways for reaching smallholder farmers. Similarly, if Ensibuuko tried to lend directly to the farmer, bypassing the VSLA, they would have to deploy more resources to deliver and recover the loans, and most likely such a model would not be viable.

- We need to build on signs that formal and informal financial service providers can co-exist in a win-win relationship. The linkage in most cases will require an intermediary that thinks differently. Trying to adapt the classic lending models of banks might not make the deal. Formal FSPs need to acknowledge that they can channel capital to the last mile through other partners like fintechs that are built with specific models and processes to serve such segments.

- We need to foster collaboration between new players (fintechs) and traditional FSPs for serving currently underserved market segments. For example, the partnership between Ensibuuko and UDB would not have happened without the involvement of UNCDF and FAO. While such collaborations have gone mainstream for digital payments, there are a few examples of other services like lending and saving. Current examples of partnerships are mainly for consumer lending purposes – based on telecom data.

These insights and the proof of concept of digital transcend payments, can guide efforts by the regulators, industry players and development partners to test and enable digital lending for productive purposes, with a focus on rural informal markets. Bridging the gap between formal and informal access to finance will boost financial inclusion and financial health for people currently in informal land.

Previously posted at :

RELATED NEWS